Photo from Canva

What you'll find in this article:

Years ago, a big part of the 2008 financial crisis stemmed from tens of thousands of mortgages in the hands of unqualified home buyers with house payments that over-extended their incomes. As a result, long gone are the days of little to no documents needed to secure home financing.

These days, you can expect lenders to require many pages of qualifying documents, either virtually or by hard copies, but most likely both. Preparing the paperwork months in advance helps you present the correct financial paperwork to the lender, saving everyone time.

Most often, lenders request the following documents and information to process your application. Although much of this documentation is readily available for applicants, some pieces might take a longer period of time to research and correct, for example, an erroneous credit report.

Your Credit Report

It’s critical to have an accurate credit report. Retrieve yours for free once per year at Annual Credit Report.com. The havoc of a stolen identity or even simple clerical errors negatively affects how lenders perceive your ability to repay their loan. Keep in mind; lenders view your credit to gauge your financial capacity to buy a home. This situation is much different from a property manager running a credit check to rent an apartment or house.

Lenders look for issues like:

- Past-due accounts

- High account balances

- Fraudulent or inaccurate activity

- Lack of credit history

If the lender has questions about any problems noted on your credit report, you’ll have the chance to write an explanation letter detailing the issue and how you’ve corrected the problem.

If you’re worried about what your credit report says, read Can I Buy a Home with Bad Credit? to help you find home buying solutions.

back to top

Photo from Canva

FICO Score

Lenders also use your FICO score to determine if you’re a good candidate for repaying a loan. If you don’t know your FICO score (scores range from 300 to 850), it’s a good idea to take a look before applying for a mortgage. FICO scores you on multiple factors pulled from your Equifax, Experian, and Transunion reports, including:

- Payment history

- Amounts/debts owed

- Years of credit history

- Types of credit

- New credit

Your FICO score is one of the main numbers lenders look at because it helps them calculate interest rates and fees on your mortgage. There is a minimum score to qualify for buying a house, sitting around 620 for a conventional loan. But, if your FICO is lower, there are options for other loans, especially a VA loan—the minimum requirement is normally 580.

Download our free home financing ebook: What to Know About Your Finances Before Buying a Home.

Loan Application Basics

Your lender will ask basic questions as they enter the information, but you can also expect to produce hard copies to verify finances. They’ll probably also ask for these documents and information:

- Legal name

- Birthdate

- Social Security Number

- Photo ID

- Phone numbers and emails

- Marital status

- Children’s ages

- Residential history for at least two years

- Immigration paperwork, if needed

If you own more property or have other mortgages, your lender will also ask to see information about:

- The address

- Current property value and status

- Lender name and account number

- Loan type

- Monthly payment amount

- The unpaid balance on the loan

- Property’s purpose: second home, rental, or investment property

- Property’s monthly expenses

Present and Past Employment

Gather a list of employers for a minimum of two years, including complete names, dates, and addresses, as your lender will ask for the information. Lenders like to see stability within your work history, so they’ll require W-2 statements to verify employment.

Photo from Canva

Proof of Income and Banking Histories

Two to four months of Leave and Earnings Statements (LES) are usually sufficient for service members. Civilians need pay stubs for two years if paid by salary. Workers paid hourly may have to show more documentation from the company’s human resources department. Commissions, bonuses, and self-employment income all need verification as well.

Recent statements from checking, savings, investment, and retirement accounts are verified. Then, the loan specialists use the documents to see if you can afford to make the mortgage payments and the often hidden expenses of owning a home.

You might not need them all, but go ahead and start the search for most of these documents:

- LES

- Pay stubs

- W-2 forms from the past two years

- Statements for checking, savings accounts

- Investment accounts documents: 401(k)s, IRAs, CDs

- Brokerage accounts

- Cash value from life insurance

- Alimony and child support documents

- Rental property documentation

- Documentation of rental income: copy of the lease, property appraisal report, income earnings

If self-employed, you’ll show:

- Year-to-date profit and loss statement

- Proof of unpaid accounts receivable

- Two years worth of 1099 forms

Take a look at: Home Financing: Is It Better to Use a Local or National Lender?

back to top

Debt-to-Income Ratio

A debt-to-income ratio (DTI) is a crucial figure for lenders. They use it to consider the applicant’s ability to repay the loan. Your total income is assessed, and fixed debts such as car payments, credit cards, and school loans are considered. You’ll also need to divulge bankruptcies and foreclosures with all of the associated documents attached.

Debt-to-income ratio consideration by the lender is why you often hear that you shouldn’t make significant purchases right before applying for home financing. Instead, you want to prove you have more than enough income to take on new house debt.

Lenders will ask about:

- Credit card balances

- Student loans

- Personal loans

- Auto loans

- Medical bills

- Child support and alimony

- Job-related expenses documents, if needed

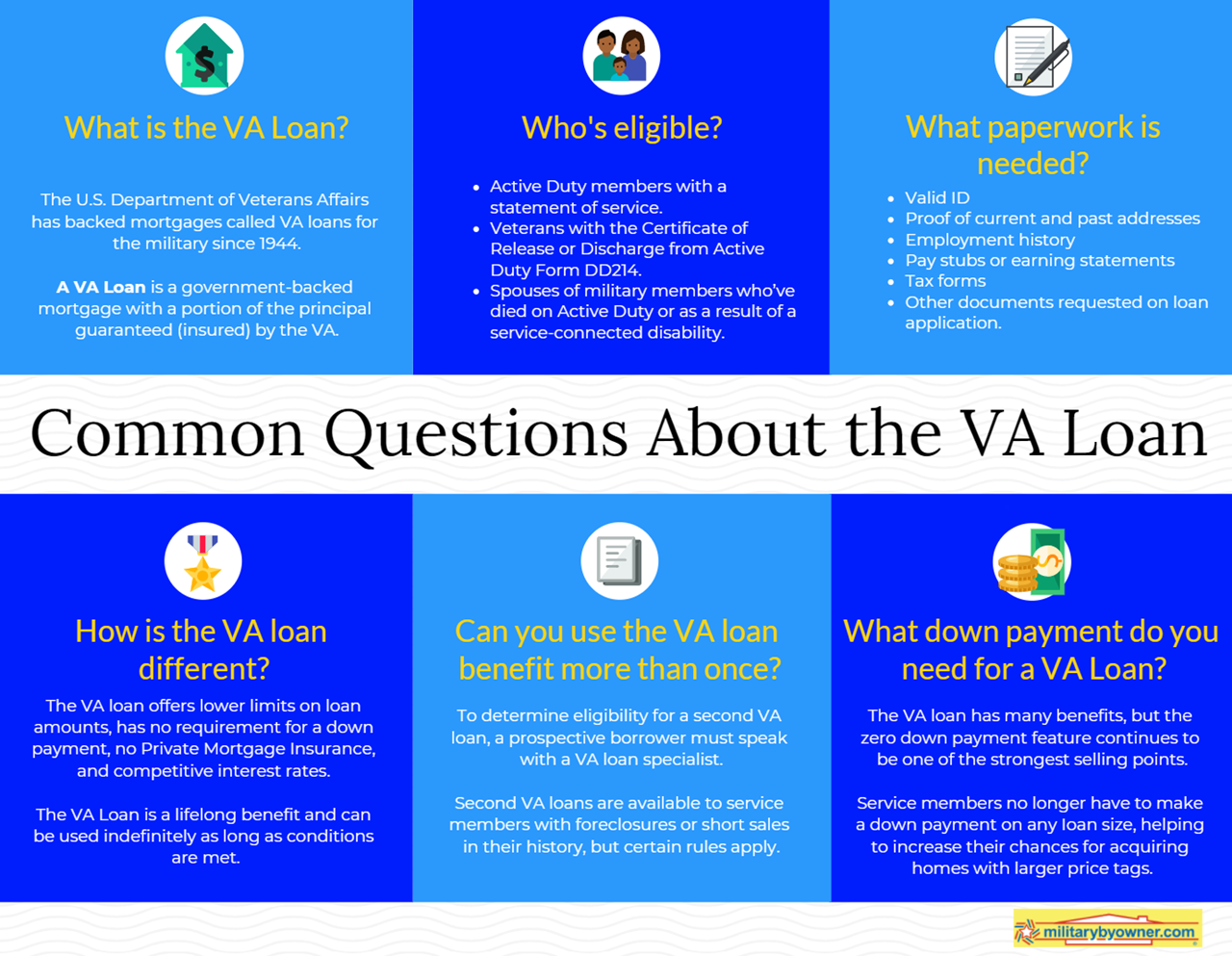

VA Loans and Certificate of Eligibility

Past and present service members often use their VA loan benefit to buy a home. For this loan, you need a bit more documentation through a Certificate of Eligibility (COE). Often, a lender has access to the Web LGY system to verify the COE quickly by submitting an online application.

However, some applicants must secure the COE through other methods if the VA lacks information. To receive a COE, active duty members need a signed, current statement of service. Veterans will need to show a copy of DD Form 214, with particular attention paid to items 24 and 28, which refer to character of service and reason for separation.

The US Department of Veterans Affairs has a complete description of the specific groups entitled to a VA loan and other options to obtain a COE. It also is an excellent place to get familiar with VA home loans in general.

Also see Home Financing Overview for Military Home Buyers.

Other Documents Some Applicants Need

There are a variety of circumstances buyers encounter in a lifetime, and the lending institution investigates some of these events. Depending on your experiences, prepare to submit the correct information.

- Your current landlord’s contact information and proof of on-time rental payments.

- Explanations of tax liens, if you have them.

- If you own more than 20 percent of a business, you’re considered an owner. You’ll supply self-employment business tax returns and year-to-date profit and loss statements.

- Divorce decree for tallying child support and alimony payments.

- A signed letter from a donor stating gift funds for the down payment isn’t a loan.

Gathering the items listed above is a smart way to start the loan process, but if you need help, reach out to an experienced loan officer as they’re trained to help clients find ways to secure the preferred documents the quickest way possible.

By Dawn M. Smith

Ready to buy a home? The time to get your finances ready is now. Download our free guide below!