Photo from Canva

In this article:

Considering a home purchase while serving in the military or as a veteran is likely one of your most daunting lifestyle decisions. The struggle lies not only with the simple decision of whether or not to buy a house but also in understanding the entire preparation process.

It’s not uncommon for first-time homebuyers to become overwhelmed. You’re learning a new skill—how to successfully purchase a new home. Part of the learning process is to arm yourself with reputable guidance and information, such as this resource.

Don’t worry; you’re not alone in this process. The National Association of Realtors reports that half of active duty military buyers are first-time buyers, which means there’s plenty of experienced real estate professionals (likely a military spouse or veteran) out there ready to lead you through the process.

But, before you reach out to a real estate professional, take the time to find out precisely what it takes to buy a house. Your agent will thank you for doing the hard work ahead of time, and the process will move more efficiently.

3 Ways to Prepare Your Finances Before Buying a Home

You’ve likely already spent hours online choosing paint colors, layout plans, and planning your first barbeque on your new patio! If only buying a house was this simple. It’s easy to get swept into the homebuying fantasies online house shopping provides. It’s practically a verified pastime in the U.S.!

The truth is, the home buying process could easily start at least a year out from your preferred purchase dates, depending on the health of your finances.

Watch our video Home Buying: Preparing your Finances

Campaign Creators on Unsplash

1) Begin to Build and Repair Your Credit

Loan officers base their decision to lend money to buy a home on the strength of your credit. Perfect credit isn’t required, but the better your numbers look, the more attractive interest rates you’ll be offered and the more buying power you’ll have.

It’s a smart financial habit to take a look at your credit report about once a year. As long as this request is directly from the credit agency, such as obtaining your FICO (Fair Issac Corporation) score from myFICO.com, or a credit report check at annualcreditreport.com, there shouldn’t be a fee, and your inquiry should not lower your credit score.

If you’re curious about where your FICO and credit scores fit, take a look at these numbers and how they apply to borrowing money.

Reviewing your accounts serves as motivation to organize and examine your creditworthiness. You’ll want to take the time to correct inaccurate informational mistakes (addresses, name variations) and possibly address fraud. Your credit reports also serve as a truth meter as to whether or not you need to work on paying off harmful debts such as credit cards.

If you’re hoping to improve your credit score, realize that closing an account you don’t use won’t be a quick fix. A closed account will still hang around on your credit report. You could also lose points for trimming back your "credit utilization ratio" or spending limit. However, if that credit card has too high of an interest rate or if it serves as a temptation for impulse spending, it may be worth the risk to close it out.

Also, note that even though you’re trying to build credit, it’s not in your best interest to open multiple new accounts just to boost your number. Each credit inquiry takes a few points off your score.

Worried about your credit score? Learn more:

2) Budget Wisely and Review Your Finances

As a renter, you’re probably thinking of basing what your future mortgage will look like either on the rent you pay now or a current or future BAH figure. These are good starting points, but depending on your home purchase location and a myriad of other personal situations, these numbers could change.

A standard calculation used to determine a housing payment is to aim for 28% to 30% of your gross income. But, we all know military life rarely fits into a one-size-fits-all category. Another option for budgeting a house payment is to use the 50/30/20 Budget: 50% for needs, 30% for wants, and 20% for savings and other debt.

An online mortgage calculator is a helpful tool for predicting an affordable mortgage payment.

Don’t forget; there are expenses beyond your monthly mortgage payment. As noted in the budgeting tips shared in our ebook, Finding Your New Home: Househunting Tips & Mistakes to Avoid, if you’re thinking about buying a house, you’ll need to sit down and figure out how far you can stretch your paycheck each month to address:

- Utilities

- Homeowners insurance and/or private mortgage insurance.

- Property taxes

- Homeowners’ Association (HOA) dues

- Landscaping/pool maintenance/pest control services.

For more in-depth information about preparing your personal finances for a home purchase, read, What to Know About Your Finances Before Buying a Home.

3) Save Your Money

Unlike a shopping trip for an everyday purchase, buying a house is a big deal. You’ll need to be financially prepared to take on a costly loan. When looking at your bank statement, think realistically about how much money you’ve saved to buy a home. You’ll need to have a healthy amount of cash in reserve to cover:

- Earnest money: A portion of your down payment that shows a seller you have a strong intent to buy.

- Down payment: A percentage of the cost of the home. Having money up front can help lower your mortgage payment.

- Closing costs: A percentage of the purchase price, often up for negotiation with the seller.

- Immediate renovations: Maybe you need to repaint? Perhaps you require new carpet or something more expensive, such as a new HVAC system.

- Emergency fund: Although three months’ pay (or more) is recommended, having a cushion of at least one month of take-home pay in your savings will help in a pinch.

It’s important to be confident that the money you’ve saved can cover expenses that occur with a real estate transaction. Our post, Preparing Your Finances For Buying a House, encourages a potential homebuyer to create a realistic budget. A working budget serves as a guide for building the balance in your savings account.

back to top

How to Find a Real Estate Professional

There are multiple reasons a vast majority of military buyers use the expertise of an experienced real estate agent, but the most significant reason is that most families simply don’t have the time or resources to take on a DIY approach to buying a house.

Photo from Canva

Hiring an expert removes some of the stress from an already nerve-racking situation. From the contract details to the relationships they have with other pros, such as mortgage lenders, renovators, and appraisers, a go-getting agent is invaluable, especially during challenging sellers markets. Also, when planning your home buying expenses, keep in mind that in most states, the sellers pay the buyers agent’s fees.

When looking for a military-friendly real estate professional, try these strategies.

- Browse through the real estate business listings in MilitaryByOwner’s directory.

- It’s a good idea to check the references that an agent shares with you. You’ll want to hear from other military families about their home buying experiences with this person. Check reviews.

- Consider a real estate agent with the Military Relocation Professional designation. This is an agent who’s gone through specialized training related to the specific challenges military families face during the buying process.

The ultimate goal is to find an experienced agent that you’ll feel comfortable working with and have no trouble engaging in open and honest conversations about what you are looking for in a property. If there’s a solid match, you can expect a friendly rapport and trust that your agent is working on your behalf to find your best housing solution.

What to Discuss with Your Real Estate Agent

Of course, you’ll share your wish list with your agent, and they’ll use this guidance to begin the search for a home, but you’ll also want to be prepared to offer what you plan to do when the time comes to move again, a.k.a., what’s your exit strategy?

As odd as it might seem, there’s good reason to know how to manage the property when you move, even before you buy. A seasoned agent knows this and will help you understand the benefits of purchasing various homes as they fit your exit strategy needs. Not all homes fit into a potential rental home category, nor do they necessarily fit into a situation when you’ll earn money on the sale after a short two to three short of living there.

Are you surprised there’s so much to think about before you dive into homeownership? What Military Families Should Consider When Making the Decision to Buy or Rent a Home helps guide your decision on whether or not to become a military landlord.

Learn more: Buying a Home with Renting in Mind

back to top

Clearly Explain Your Housing Priorities

No one is more invested in your home purchase than you. Even the hardest working agents have other clients to attend to unless you work with an exclusive buyers agent, so you must be prepared to do some of the legwork, including scouting crime and safety statistics.

It's a given that most military homebuyers’ top housing priorities are the safety and security of the neighborhood. But your agent is limited in what they can tell you. They are bound by federal fair housing laws, which means they cannot delve into the details of a school or crime statistics in a neighborhood you are considering. “Is this a bad neighborhood” or “Is this a good school?” are common questions, but the answers are difficult to share. Most agents will point to general websites like Niche.com and Community Crime Map or research for you to engage with to make your own decisions based on data.

Watch the following short video for Realtor Karen Hall's advice for finding out if a neighborhood is good or bad.

Safety is important, but other quality of life factors can make or break a home search. By doing your homework early, you can quickly share with your agent your top priorities. Common topics for you to explore include:

- Commute and distance from work and school

- Budget restrictions

- School qualities and ratings

- Crime statistics

- Work opportunities for the spouse

- House features: bedrooms, bathrooms, layout, style

If you’re curious to know what kind of house your fellow military colleagues are buying, here’s what the NAR profile of active duty buyers looked like in 2018.

- 4 bedrooms and 2 full bathrooms

- 2,050 square feet

- Median home price: $254,800

If you want to see how your must-haves stack up against other recent buyers and home shoppers, these are the categories Kiplingner and the NAR report as the highest percentages of preferred home amenities in 2020.

- Laundry room, 91%

- Energy efficiencies-appliances and windows, 89%

- Patio, 87%

- Ceiling fans 85%

- Garage storage, 85%

Learn About Financing and the VA Loan

Remember when we discussed the health of your finances and how to increase your buying power? All of that time-consuming prep work equals the chance to obtain favorable financing options for your home purchase.

Photo from Canva

Now, it’s time to seek a ballpark figure of what you can afford. This informal process is called pre-qualification and is often casually handled online with banks or lending institutions that you have a relationship with. The results of your pre-qualification inquiry begin to reveal how much money you can invest into housing. For a fine tuned amount, you’ll continue to the next step, which is applying for pre-approval for a mortgage.

The differences between pre-qualification and pre-approval are often confused. These resources help sort the differences.

A pre-approval is a much more detailed examination of your finances and credit. If you receive a statement of pre-approval, you’ll have a conditional commitment for an exact loan amount. A pre-approval for a mortgage is ideal because it helps define your house hunting price range. Later, you can place an offer in a competitive market knowing you’ll already have your financing lined up.

However, even with mortgage pre-approval, there’s no guarantee for financing. It’s simply your lender’s way of saying they will most likely approve you for a certain amount if everything checks out with your loan underwriting process.

back to top

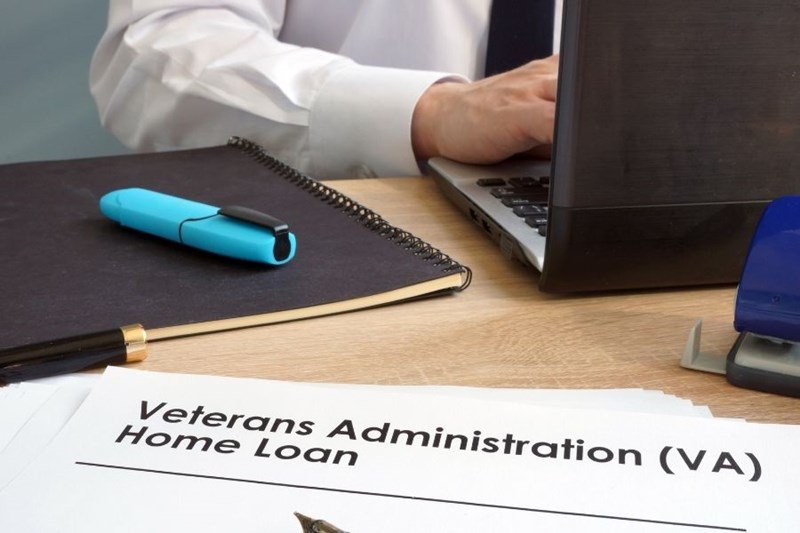

Why Military Members Love the VA Loan

VA loans are by far the most popular loan product among active duty and veterans. For one reason, a down payment isn’t needed to be approved for the loan, and for the second reason, VA loans don’t require private mortgage insurance (PMI).

In general, VA loans have the least stringent qualifications because the federal government guarantees all private lenders’ loans. However, those lenders may have particular qualifications, such as the 640 credit score average mentioned earlier. This score is a calculated signal to the lender that implies you can make timely and complete payments.

Before signing on the dotted line, it’s a good idea to do a little homework on what is and isn’t included in this type of loan. For example, 9 VA Home Loan Facts You May Not Know explains,

"Although a VA loan does not require a down payment, borrowers should know this doesn’t mean cash isn’t needed for the transaction. Even though the terms of this mortgage are more favorable than others, there’s still a need to have a healthy savings account in order to provide cash when requested.”

Because the VA loan is commonly used, take the time to become acquainted with its benefits and limits.

More Government-backed Loans

Sometimes other government backed loans make your financing journey easier. Here are a couple more options.

- The FHA Loan: the Federal Housing Administration’s loan has a down payment for as little as 3.5% of the home’s price.

- The USDA Loan: borrowers can apply without a down payment and reduced interest rates.

Conventional Loans

Although most military members at least consider a VA loan first, there are other loan options. Some conventional loans could be better for your financial situation, especially if you have a big down payment. Conventional loans aren’t backed by the government like the VA loan but by private lenders. If you go this route, you'll hear about:

- Conforming mortgages: follow guidelines set by government agencies like Fannie Mae and Freddie Mac.

- Non-conforming loans: also known as “jumbo” loans and used for higher than usual home loan amounts.

- Subprime loans: borrowers with low credit scores can take advantage of this option.

Learn more: Which One Is Right for You? Comparing Conventional and VA Home Loans for Military Homebuyers.

Home Buying Process

Place an Offer

Let’s say the stars have aligned, and you’ve found a home that fits your budget and needs. With your agent at your side, make an offer, but know that it may not be initially accepted when you present your formal purchase offer to the home seller.

They may suggest any number of remedies, including offering a more significant amount of money, the option to waive inspection fixes, or loosening the timeline, allowing the sellers to live in their home for a few extra weeks.

Our free ebook, Making an Offer & Closing On Your New Home offers insight on how to appeal to the seller with the perfect dollar amount and ideal closing terms.

back to top

Present an Earnest Deposit

After the seller accepts your offer, you’ll both sign a real estate contract. At this point, a buyer typically fronts a certain amount of money called an earnest deposit, which is placed into an escrow account. This good faith money is returned if there’s an issue with financing the mortgage or if the home does not pass inspection.

Review Disclosures and Arrange for Inspections

Your agent will be your guide as you navigate through the appraisal, disclosures, and inspections that lead towards final approval from your lender. During this timeframe, you’ll have the opportunity to analyze various documents, such as flood maps, geological surveys, and private property ordinances. It's possible that researching county records for outstanding home inspections will give you an idea of what you might find during your current inspection.

Romain Dancre on Unsplash

Disclosure Statement

A disclosure statement is a list of flaws that could affect the home’s value. It's given to the buyer before closing so they can decide whether or not to proceed with the sale. The specifics vary by state, but if the disclosure statements aren’t accurate, you have legal options later if problems occur.

Basically, the sellers have to disclose major problems that aren’t visible to the naked eye. Trained inspectors and real estate agents can see telltale signs, but everyday buyers won’t pick up on the clues. On the other hand, if significant problems like water damage and mold are found and fixed correctly, the seller does not have to disclose its history.

If you’re considering an “As Is” property, know that the seller isn’t required to provide a disclosure statement and they don’t intend to take on any repairs before closing. They also don’t guarantee everything is in working order, so you’re on the hook for any future repairs, large or small. However, the sellers have to meet state and federal disclosure standards, which reveal issues like lead paint.

Here’s more about what home sellers have to reveal before closing.

You’ll want to proceed with caution if their disclosure includes big-ticket improvements, such as:

If these situations are revealed, you have the option to cancel the deal. Your escrow deposit would be returned, and you could walk away. However, if you’re still interested in the home, your agent can help you renegotiate the terms to have the seller resolve the outstanding issues or reduce the sales price.

Home Inspection

For reassurance that this home is a worthwhile investment, arrange for a home inspection. Don’t be fooled by outstanding curb appeal! An inspection ensures the nooks and crannies of the house are as pleasing as the exterior. You’ll likely have to share the home inspection report with the lender for the loan to process.

Real estate agents typically have a couple of professionals in mind to inspect the residence. If there’s anything that doesn’t correlate with the seller’s disclosure statement, this is another opportunity for you to either cancel the deal or renegotiate the terms of the sale.

Remember, many states are “buyer beware” states, meaning it's up to you to ask questions, hire professional home inspectors, and do plenty of research before finalizing your purchase.

For more information about what to look out for before buying your property, watch this video.

Final Loan Approval

The lending institution has the final say in whether it agrees to release funds for a mortgage, but they must confirm a couple of things. These are two items that will make or break your potential home purchase:

- Your ability to make timely payments.

- The appraisal value of the property.

Over several weeks, the lender has been delving into your financial profile to ensure you’ll be accountable for a home loan. Even if you have a statement of pre-approval, a lender will investigate further to protect their end of the deal. Before loaning you any sum of money, the lender wants to be sure you can comfortably cover your monthly mortgage payment.

While your finances are in review, it’s in your best interest to hold off on making any major purchases. By limiting your spending, you keep your debt-to-income ratio intact.

To gain a sense of what the home you are buying is worth, the lender will set up an appraisal inspection and compare the property to other houses on the market. This will clarify if the sale price meets the value of the property. Of course, you or the seller are allowed to contest this appraisal if you feel the assessment is incorrect.

Take Inventory of the Property

A day or two before the scheduled closing date, you and your agent will take a final tour of the property. With this walkthrough, you’ll inventory what is included with the home, which could be the appliances, the window treatments, or anything else you’ve defined in the contract.

Photo from Canva

From the inside to the outside, take note of the house’s overall condition and compare it to what you’ve included in your contract. If any detail has been overlooked, your agent will address those concerns with the seller’s agent. If everything around the house meets the terms of the contract, you can give your approval, and the home buying process moves towards closing.

Keep in mind, before you state your approval that the home meets the standards of the contract, this is your last chance to opt out of this purchase.

How to Prepare for Closing

Now that you’ve done your due diligence, checked the property’s official documents with the local and state agencies, and understand exactly what you’re inheriting after the home inspection, you’ve inched closer to the official closing day. But, there’s one more thing to consider if you’re buying a home or condo with a homeowners or condo owners association.

The home seller must disclose the official association documents for your review. After that, you have three days to make sure you can (or want to) meet the association’s requirements. If, for some reason, you don’t want to make the purchase after you’ve considered the regulations, you’re free to leave the contract. Learn more about HOAs.

Closing Day

With this military lifestyle’s mobile nature, it’s good to know that your closing appointment can occur wherever you are located. You may meet at the agent’s office or sign paperwork remotely. You can decide what works best for your current situation. Regardless of how or where you sign, this is the paperwork related to closing day.

- Photo ID: Either your driver’s license or current passport.

- Down payment: This may be in the form of a cashier's check, certified check, or wired money. Before your appointment, you’ll be told the exact amount.

- Closing costs: Usually, 3 to 6% of the loan amount is paid to the lender for processing fees like a title search and home appraisal.

- Proof of home insurance: A receipt showing you’ve paid the home insurance policy.

- Final purchase and sales contract: Your copy of the paperwork.

When you’ve paid the lender, read through the documents, and signed more papers than you care to think of, it’s a wrap. Once the notary signs and seals the final paperwork, those precious house keys will rest in your hand for the first time. It’s time to celebrate! You are now a homeowner.

MilitaryByOwner understands your need to prepare for homeownership. We encourage you to browse our articles, posts, and ebooks. We’re happy to offer a sense of guidance and support as you find a home of your own. Download our free guide below!

By Dawn M. Smith

back to top

Did you enjoy this article? Please use the image below to share it to Pinterest!