How to Best Serve Those Who’ve Served Our Country

Photo from Canva

In this article:

Introduction

Your newest clients are recent transplants to the area and looking to buy a home. The family is living out of suitcases in military temporary lodging (a glorified hotel), paying for their pets to be kenneled, while their kids adjust to their new school and attempt to make friends. On top of that, they inform you that they have about a week to find just the right place. No pressure, right?

These are not your typical home buyers.

As a real estate agent, you probably realize that buying a home as a military family is a completely different experience from that of civilian home buyers, but you may not be quite sure how to help.

And for military homeowners looking to sell? There’s a lot to understand. Most PCS moves (Permanent Change of Station—we’ll get into some of the terms you should be familiar with if you’re working with military clients) tend to happen during the typical “PCS season," the end of spring into summer, which is already a busy real estate season. That said, military members can move or separate from the service any time of the year.

There’s so much more to know about military homeowners than only the ins and outs of the VA home loan process, though that is helpful information to have, too! A knowledgeable agent can make the difference for a military member or veteran buying or selling a home. And you don’t have to live near a military installation to have veterans and servicemembers be part of your clientele, as veterans can move anywhere after they retire.

Let’s cover a few basics.

Military family image via Fort Drum MWR

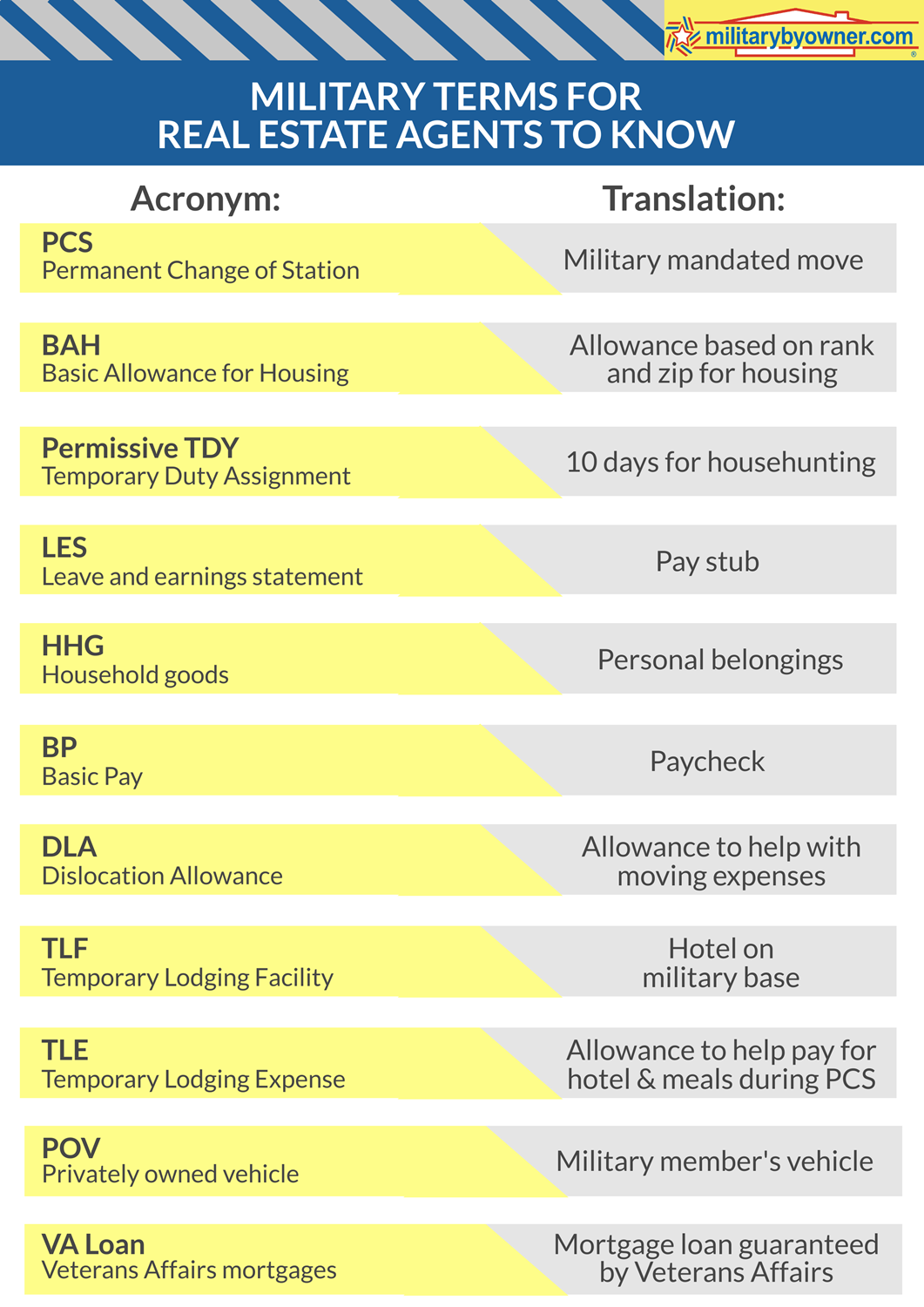

Military Terms to Know

The military loves acronyms, and it may seem like military members and families are speaking a foreign language... and in some ways, they are! With its specialized terms, the military is not unlike the real estate world. We’ve made it easy for you by compiling the following list of military terms that apply military relocation (PCS moves).

Key Points to Understand

Military families typically experience a shorter window for home shopping or selling, may be handling some of the process long distance, or even have one spouse signing all the paperwork while the other is deployed or traveling. They may also be in the middle of a cross-country or international move, all while trying to sell or buy a home.

A U.S. Sailor reunites with his family at Naval Station San Diego, Calif., after returning from a seven-month deployment aboard the guided missile cruiser USS Princeton (CG 59). Photo via U.S. DoD.

All of these unique characteristics can make for some challenges, but that also means that military families are usually motivated buyers and sellers. They also tend to be:

- Experienced movers.

- Organized.

- Have paperwork ready.

- Loyal—if they have a good experience with you, they’ll spread the word! Military families can be a great source of referrals.

- On a strict budget.

.png)

back to top

What to Know About Military Home Buyers

Military families are looking for the same home features as any other home buyer: good schools, an easy commute, room for kids to play, and access to amenities. But it’s important to also understand some differences.

Since military members will usually be on an accelerated timeline for finding a home, they probably won’t be endlessly home shopping and revisiting homes over several weeks.

Photo from Canva

Note that, if the service member is deployed, about to deploy, or away for training, the spouse may be handling the entire process (including closing) with a Power of Attorney or the military member could be signing paperwork remotely. If you’re dealing with parts of the home buying process long distance, have a willingness to answer questions or deal with documents at odd hours.

“I love working with military families. I find them to be decisive, and they move quickly without drama. I am a military wife, so I treat them like family and make them the most important client that I have, because I know what they are going through. The next move they make should feel like an adventure, not a chore.” -Lori Ann Coyne, Virginia Realtor

Understanding BAH

Photo from Canva

While, of course, civilians also have budgetary constraints and considerations, the military member will likely want to stay within or close to their BAH (Basic Allowance for Housing). The BAH is a benefit given to military members choosing to reside off base, and varies by location and rank. Some service members will also receive a COLA (Cost of Living Adjustment) for pricier areas.

“The Basic Allowance for Housing (BAH) is a U.S. based allowance prescribed by geographic duty location, pay grade, and dependency status. It provides uniformed Service members equitable housing compensation based on housing costs in local civilian housing markets within the United States when government quarters are not provided.” -Defense Travel Management Office

The DoD's BAH calculator is a great tool for homebuyers to help determine their budget when purchasing a home. As the agent, you can also do a little research on BAH in your area.

Learn more about the ins and outs of BAH here.

Tips for agents working with a military home buyer:

- Military families get 10 days of "permissive leave" to house hunt. They'll be on a compressed home shopping schedule.

- Realize that some part of the home buying process could occur while the military member is deployed or traveling for military service.

- Military families may not be able to view potential homes in person. You may need to do a video tour and be their eyes and ears.

- Active duty military (and some veterans) may be limited in their home search area, as they will want proximity to the military installation.

- As military homebuyers will most likely be new to the area, they will have questions about the safety of neighborhoods and good school districts. While you can’t answer those types of questions due to the Fair Housing Act, you can point them to resources available for them to research these topics, like our free resource: Househunting Tips & Mistakes to Avoid.

- The homeownership rate for veterans is 78%, 14 percentage points higher than the general population. (Source) Become well versed on the details of using the VA Home Loan benefit (keep reading to learn more about this below). Remember that both active duty members and veterans can use the VA loan.

- Most military home buyers won’t be interested in a "fixer upper" due to the limits set by the VA loan as well as the fact they may be moving from the area in just a few years and will either be looking to sell or rent the home.

back to top

What to Know About Military Home Sellers

Not every military family has the luxury of several months’ notice that they will be moving. In some cases, they will get orders to be at their next location in 60 days or less. This can cause significant stress for homeowners who need to sell.

As with home buyers, the military member may be absent due to deployment or training, with the spouse handling much of the paperwork and showing the home. Again, they may be dealing with certain aspects of the home selling process long distance. As a military homeowner, much of what needs to be done for a home sale may look the same as a conventional home sale, while other steps will be drastically different.

Home sellers who decide to use an agent’s services may be looking for a REALTOR® who has earned the certification as a Military Relocation Professional, which means they have completed training to better help military families navigate home buying and selling.

Making the Decision to Sell

Building home equity as a military homeowner is more complicated than it is for civilians, as the military lifestyle often calls for frequent moves and short stays. Military homeowners will need to consider several factors in the sell vs. rent decision.

Photo from MilStock Tribe

Housing trends: If the seller’s market in your area is favorable, it might make sense for the military member to sell now. Guide them with information about housing markets nationwide as they make the decision, especially those located near their military installation.

Renting out the home: Renting the home may be the best option due to real estate trends or the desire to build more home equity. However, the homeowner might rather not deal with the details of suddenly becoming a landlord or they may not have the resources to upkeep a rental home or hire a property manager.

We spell this out more in our post specifically geared towards military homeowners, Should I Sell My Home or Rent It Out?, including the following:

"Chances are, the decision to move was made for you by the military, and unless you want to start a rental business, you’ll have to sell. If you’re on the fence and need some help deciding whether or not to sell or take on the new role as a first-time landlord, consider these questions:

- Do you have the time to learn landlord/tenant laws?

- Will you hire a property manager?

- If you're marketing to military families, will they like the location?

- How much work does the house need to become a rental property?

- Do you have the cash to make the updates and future maintenance over the lease term?

- Do you anticipate the house needing significant repairs due to its age in the future?"

Tips for agents working with a military home seller:

- While there is usually an ideal time of year to put a home on the market in most locations, military families won’t have much leeway if they’re moving due to military orders.

- Encourage military home sellers to share their listing on as many outlets as possible, including virtual tours, social media, and sites like MilitaryByOwner (real estate agents can create a listing on MilitaryByOwner, too!).

- Prepare the military home seller for common contingencies.

- Provide them with info on how to be prepared to sell to a buyer using the VA loan. Start here: Selling to a VA Loan Buyer.

- Be aware of costs that a buyer using the VA loan will usually pass on to the seller. Closing and processing fees are deemed non-allowable fees by the VA.

- Point home sellers to information about what to expect at tax time, especially regarding capital gain taxes for military. Here's more specific info for military home sellers: The Effect of Capital Gain Tax Exclusions for Military Home Sellers.

- Remember that military homeowners may be closing on the home remotely.

We're here to help! Our free Guide to Selling Your Home is an invaluable tool for military home sellers.

.png)

back to top

The VA Home Loan

The VA loan is one of the best options for active duty military and veterans. Millions have benefited from the favorable terms of the VA loan, and the program remains popular as it removes many barriers typical buyers face, especially first-time home buyers.

Photo from Canva

A VA Loan is a mortgage backed by the government with a portion of the principal guaranteed by the Department of Veterans Affairs. In an effort to encourage a bank, credit union, or lending institution to finance a military homebuyer, the Department of Veterans Affairs offers this partial pledge, as long as certain guidelines are met.

The VA loan has many benefits, but the zero down payment feature continues to be one of the strongest selling points. For years, the baseline loan guarantee limit was $424,100 for much of the country, although for expensive areas, such as Washington, D.C., it was guaranteed up to $679,650. Home buyers wishing to purchase beyond these prices had to come up with a 25% down payment.

However, as of January 2020, this down payment requirement changed. Service members no longer have to make a down payment on any Ioan size, which helps to increase their chances for acquiring homes with larger price tags.

From the U.S. Department of Veterans Affairs:

A VA-backed purchase loan often offers:

- No down payment as long as the sales price isn’t higher than the home’s appraised value (the value set for the home after an expert reviews the property)

- Better terms and interest rates than other loans from private banks, mortgage companies, or credit unions (also called lenders)

- The ability to borrow up to the Fannie Mae/Freddie Mac conforming loan limit on a no-down-payment loan in most areas—and more in some high-cost counties. You can borrow more than this amount if you want to make a down payment.

Learn about VA home loan limits

- No need for private mortgage insurance (PMI) or mortgage insurance premiums (MIP)

- PMI is a type of insurance that protects the lender if you end up not being able to pay your mortgage. It’s usually required on conventional loans if you make a down payment of less than 20% of the total mortgage amount.

- MIP is what the Federal Housing Administration (FHA) requires you to pay to self-insure an FHA loan against future loss.

- Fewer closing costs, which may be paid by the seller

- No penalty fee if you pay the loan off early

The VA Home Loan benefit can be reused —multiple times, actually. Homebuyers can apply for a VA loan before another VA loan is paid in full in certain circumstances. Even service members who have faced foreclosure or bankruptcy could be eligible for a VA loan.

Our article, Have a VA Loan? Take a Second!, explains further details and examines the circumstances when it makes financial sense to look into another VA Loan.

.png)

Note that the VA loan is designed for the purchase of a primary residence. Borrowers cannot use funds for investment property vacation homes or to purchase property internationally. VA loans are typically intended to put military members in single family homes, condos, or modular housing with minimal issues to ensure a move-in ready residence. Loans for fixer-uppers are not generally approved.

The VA Appraisal

It’s important for agents to understand the VA stipulations for underwriting the home loan, including the VA’s “Minimum Property Requirements” (MPR).

Photo from Canva

A VA appraiser is required to inspect the property before the loan is approved. Some MPRs are up to the appraiser’s interpretation, while others are very specific. Some examples of what appraisers look for:

- Property must be residential.

- Must provide enough space for suitable living, including sleeping, cooking, and sanitary accommodations.

- Electrical and plumbing systems must be in good working order and have a reasonable time frame of future use available.

- Safe and adequate heating systems.

- Safe access from the street is mandatory.

Learn more about the VA’s minimum property requirements.

back to top

The Military Relocation Professional Certification

A REALTOR® in good standing with the National Association of Realtors is eligible to earn the certification of Military Relocation Professional. Military homebuyers and sellers can search a national directory of MRPs and identify a REALTOR® who genuinely understands that a military move is much different than a civilian client's move. The MPR certification is recommended for agents who regularly work with military clients.

Photo from Canva

How do you earn the MRP certification?

- Must be in good standing with NAR (National Association of REALTORS®).

- Complete a one-day MRP certification course.

- Submit an application, including any fees, to the NAR.

According to the NAR, REALTORS® who earn the MRP certification will learn:

- Demographics of the military market

- How service members can use their monthly basic allowance for housing (BAH) payment for privatized or private-sector housing

- The processes and procedures involved in a permanent change of station—called PCS—for service members and their families

- How real estate transactions for relocating military service members are unique—for example, compressed time frames or the need for power of attorney if the service member is deployed during the real estate transaction

- How to help service members through a rent or buy/sell decision-making process

- How eligible service members and veterans can leverage VA financing and entitlement benefits when purchasing a home.

Get more info about becoming a Military Relocation Professional from an MRP.

Being armed with accurate information, maintaining good communication, and staying flexible and accessible are great starts to success when working with military home buyers and sellers.

Wanting to reach the military market? Explore our business ad packages below! For more resources about military families and real estate, follow MilitaryByOwner’s blog and connect with us on social media.

By Jen McDonald

Learn more about selling and buying a home in the military:

back to top