Photo from Canva

In this article:

When you first begin shopping for houses and home loans, your friends and family will tell you to start looking at your VA loan benefit. This is excellent advice because it checks so many boxes in the “pro” column, but it’s helpful to know the application process step by step before finding your dream home since you’ll have some prep work to do.

Here’s what you need to know to start applying for your VA loan.

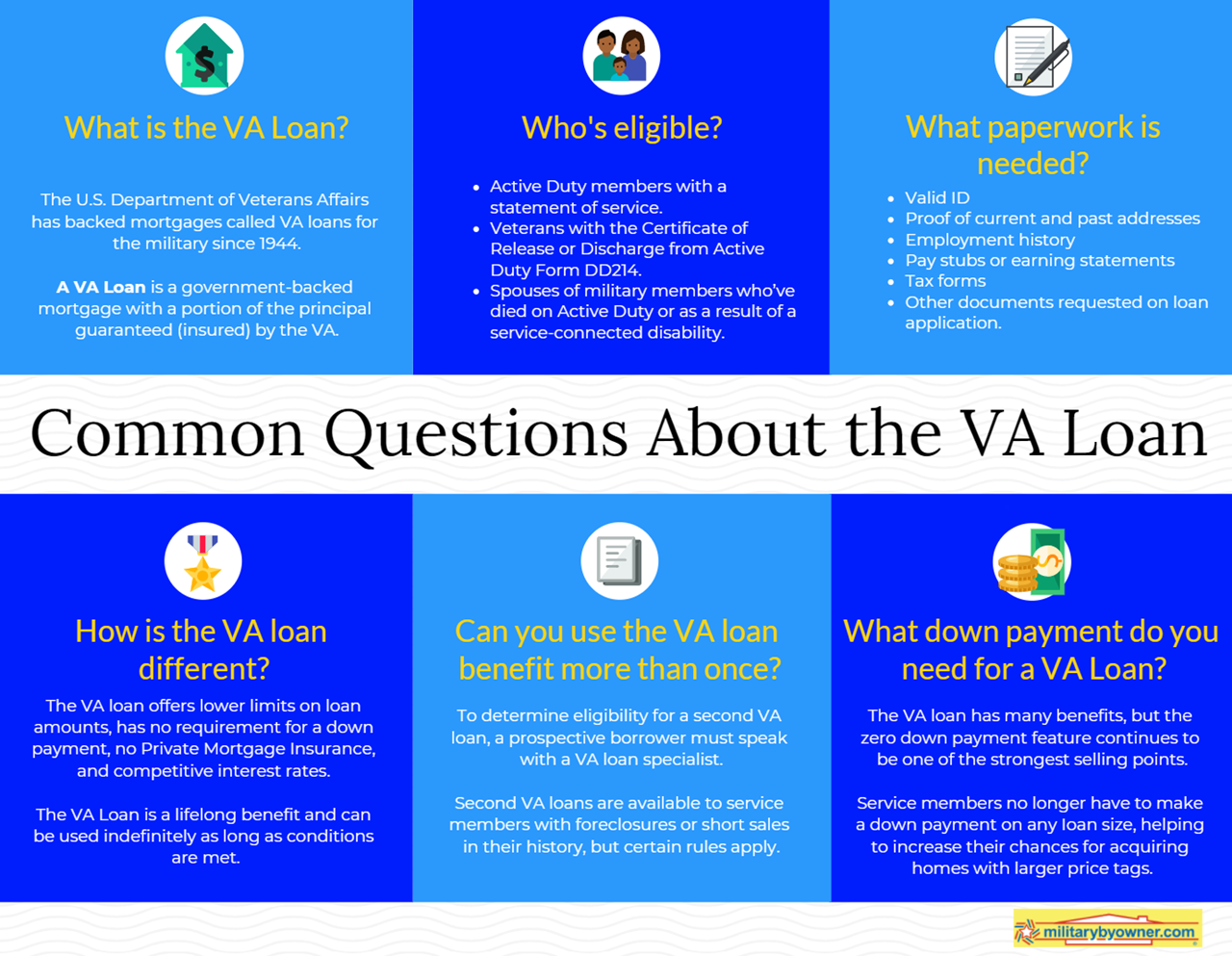

What Is a VA Loan?

A VA loan might sound intimidating for a first-time military home buyer, but it's really just a home financing option insured by the government. However, the government doesn’t actually give you the loan. This means you’ll need to find a mortgage lender or bank who knows the VA loan process forward and backward to maximize your buying power. Unfortunately, not every lender can navigate the VA loan process with ease.

As a military member, you’ve earned access to the VA Loan as a benefit for your service. There are some requirements, but many active-duty members, veterans, and their families take advantage of the VA loan’s perks each year. More than 25 million loans have been guaranteed since 1944, when the U.S. Department of Veterans Affairs created the VA loan as part of the Servicemen’s Readjustment Act.

You should also know that although the VA loan is a better than the average option for military home buyers, you're not required to use it. You may find other conventional loan options serve you better depending on your finances, home buying plans, and current market trends.

For more in-depth information about your benefit, read Understand Your VA Home Loan Benefit.

How Is a VA Loan Different from Other Loans?

You already know a VA loan is different because the government insures 25% of the loan. This makes you very attractive to private lenders, but there are other differences.

Certificate of Eligibility

A Certificate of Eligibility (COE) is required to apply for a VA loan. It verifies you’ve met the VA’s criteria for time of service, duty status, and character of service.

Most lenders have access to the VA’s Loan Guaranty System and should quickly find your COE status, so this part of the loan process should be easy. If there are issues, it's likely because the VA doesn’t have the correct information filed. If not immediately qualified, you can ask for your COE online or through the mail.

More VA Loan Benefits and Differences

There are many more reasons the VA Loan is attractive, but there are also differences compared to other loans.

- Department of Veterans Affairs loan guarantee

- Competitive interest rates

- Zero down payment

- Flexible credit score

- Private mortgage insurance isn’t required

- Reduced closing costs

- Funding fee waived for disabled veterans

- No prepayment or early pay-off fees

- Reusable lifetime benefit

First-time home buyers aren’t the only borrowers who can take advantage of the VA loan. You can reuse your VA home loan benefits.

Sometimes, home sellers have concerns about the VA loan. Learn how to debunk the myths.

back to top

Photo from Canva

How to Apply for a VA Loan in 5 Steps

After checking your credit reports and tightening up your finances, it’s time to start the VA loan process.

1. Get Your Loan Pre-Approval

Today, home sellers expect to see a home loan pre-approval letter before they’ll consider your offer. It shows them you’re committed to the buying process and financially ready. The pre-approval also shows how much home you can buy, according to lenders. It’s up to you to decide how much you’d like to spend, especially since the recent VA loan changes.

Your lender will run your credit report looking for a VA loan minimum score of about 620. They’ll also talk to you about your home buying goals, military service, and other employment. After confirming you meet the credit score minimum, they’ll ask you to supply more information to investigate your financial capacity to pay back your loan.

More information about your credit score:

Remember, this is not the time to take on new debt, like a car loan. It could dramatically change your ability to qualify for a VA loan.

You’ll need to submit multiple documents to your lender so they can confirm your buying capacity. This is some of the information you’ll supply.

- Driver’s license and military ID

- Statement of Service for active duty

- A couple of months of LES statements

- DD-214 or Reserve/Guard points statements

- Pay stubs and W-2s for the last two years

- Recent bank statements

- Disability award letters

2. Start House-Hunting

Even though you’ve probably been scrolling real estate listings for a while, now you can officially set out to find “the one.” Hopefully, you’ve found a knowledgeable lender and an experienced real estate agent to help you.

The VA loan has requirements for what types of houses borrowers can buy—Minimum Property Requirements. A VA loan appraiser must view any property you’re interested in buying to see if it meets the MPRs. Your agent can give you the heads up if they think you might have trouble meeting the MPRs with the house “as is.” You can negotiate with the seller to make improvements to meet the MPRs, but it's challenging to buy a fixer-upper with a VA loan.

Some examples of what MPRs appraisers look for:

- The home is a primary residence.

- You can only buy a multi-family unit (up to a four-plex) if you also intend to live there.

- Property must be residential.

- The property must provide enough space for suitable living, including sleeping, cooking, and sanitary accommodations.

- The electrical and plumbing systems are in good working order and have a reasonable time frame of future use available.

- The house has safe and adequate heating systems.

- Safe access from the street is mandatory.

Do I Need a Buyer's Agent to Buy a Home? answers the question and helps you find the best real estate professional.

Photo from Canva

3. Make a Home Offer and Go Under Contract

The house you’ve found checks all of your must-have boxes and makes you smile each time you go over the pictures, so with your agent and lender’s help, your next step is to craft a strong offer and go under contract. Every situation is different, but most offers have these components in common.

Read also: What to Do When Your Home Offer is Rejected.

Closing Costs

Closing costs are a big part of a home sale, so it’s important to calculate their fees and how you’ll structure them into your VA loan. Of course, it’s possible to ask the seller to pay your closing fees, but most likely, these will be part of your negotiations.

Contingencies

You’ve probably heard of a home inspection contingency, but there are other types that your agent will suggest if they suit your needs. For example, they can describe the amount of earnest money required, who makes needed repairs, closing dates, and more.

Earnest Money Protection

VA loan contracts have a built-in protection for buyers’ earnest money. The special feature says that VA buyers are entitled to their earnest money if they leave the deal after finding out the appraisal came back lower than the sale amount.

4. Go Through the Underwriting and Appraisal Process

After you’ve gone under contract with the seller, your lender sends your information to loan processors and underwriters to dot i’s and cross t’s, making sure your purchasing power and loan application is solid.

Appraisal Process

While the underwriting process proceeds (make sure to respond quickly to any questions the lender has to keep the process moving), your lender will schedule a home appraisal through the VA. Normally, the home buyer will pay for the appraisal.

The appraiser will check out comparable homes sales in your neighborhood and identify the MPRs. If, after their evaluation, the house doesn’t meet the MPRs or is appraised for less than your offer amount, you, your agent, and the seller’s team will negotiate repairs and the purchase price or choose to cancel the contract.

If your underwriting finishes smoothly and you iron out issues with a low appraisal and the MPRs, your next baby step is “clear to close,” but you have one more official step to go.

5. Close on Your Home

You, your agent, and your lender will discuss financial details again and examine the closing documents, including the Closing Disclosure. It breaks down your final closing costs and compares them to earlier estimates. This is your last chance to ask questions and understand exactly what your contract entails. If everything looks good, you’ll get the keys to your new home on closing day.

Final Walk-Through

Most times, buyers have the chance to walk through the property to check on the repairs, updates, and convey items like appliances and window coverings negotiated in the contract before signing on closing day. If you find anything out of order, let your agent know ASAP.

Photo from Canva

How Long Does VA Home Loan Approval Take?

You might wonder, “How long does it take for a VA home loan approval?” This is an excellent question because there’s a lingering myth that VA loans take much longer than conventional loans, which turns off sellers, especially in a hot market.

Although there isn’t a set time frame because each loan application is different, the timing has a lot to do with your prep work and your ability to return calls and texts with short notice. For a general guideline, you can expect the process to turn over as quickly as 30 days, but more likely, you’re looking at closing in about 50 to 55 days.

These are the factors that affect your timeline:

- Pre-approval

- Preferred buyer and seller timelines

- Appraiser’s schedule

- Repairs and updates

- Final underwriting issues

As a first-time homebuyer loan (and thereafter), VA loan benefits are hard to beat, but sometimes they’re intimidating if you don’t know the process. These detailed descriptions lay out what to expect and help you ask your real estate team informed questions.

By Dawn M. Smith

back to top