In this article:

First-time homebuyers often have more questions than answers, and it can be frustrating. Even those who attempt to research and study the process get bogged down in acronyms and large, scary-looking numbers. However, if you’ve never bought a home, a clear understanding of the answers to the most basic mortgage questions builds confidence to ask more detailed questions later during the process.

Experienced real estate professionals are the key to your quest for mortgage knowledge. Agents and bankers who know their trade can easily translate lending details into information an everyday person can comprehend.

A “Mortgage 101” guide is the best way to begin deciding if homeownership is in your future. Here’s help for studying and understanding a simple version of the process.

What is a mortgage?

In simple terms, a mortgage is a loan that a bank or mortgage lending institution provides buyers to acquire a house. In return, the house becomes collateral if the borrowers cannot pay the financing.

Owners typically pay mortgages monthly and, although paid in one sum, there are four components within the mortgage: principal, interest, taxes, and insurance.

- Principal: the total amount of money borrowed to purchase the home.

- Interest: the percentage of money paid to the lender for the opportunity to borrow.

- Taxes: refer to property taxes paid by the owner, usually tallied by the house’s value.

- Insurance: lenders require homeowners insurance.

How do I find a mortgage banker?

Reputations speak volumes in the real estate industry. Finding a trusted friend or family member who had a great experience with someone knowledgeable and with a willing spirit is the best option, especially for first-time buyers. Real estate agents also like to refer their favorite lenders because they want a competent transaction in a timely fashion, making for a smooth process for everyone.

What's the difference between pre-qualification and pre-approval for a mortgage?

Pre-qualification is the first step for securing a mortgage. A lender screens your finances, but you provide the information. There isn’t any fact-checking through credit reports or FICO scores. The process is fast, two to three days, and usually completed online. But, the amount of money you pre-qualify for doesn’t necessarily equate to your final pre-approval amount.

A loan pre-approval is a more in-depth scrutiny from the lender which requires financial documents to be verified. A pre-approval letter from a bank demonstrates to real estate agents your capacity to borrow and it tells sellers you’re financially and mentally ready to get into the business of home buying negotiations.

Your pre-approval status is based on how attractive these items are.

- A correct and fully completed mortgage application.

- Your credit history.

- Your finances, including your debt to income ratio.

- An estimate of your down payment if you prefer to use one.

Learn more: Mortgage Pre-Qualification vs. Pre-Approval: What It Means and Why It Matters

What's the difference between a credit and a FICO score, and what are they used for?

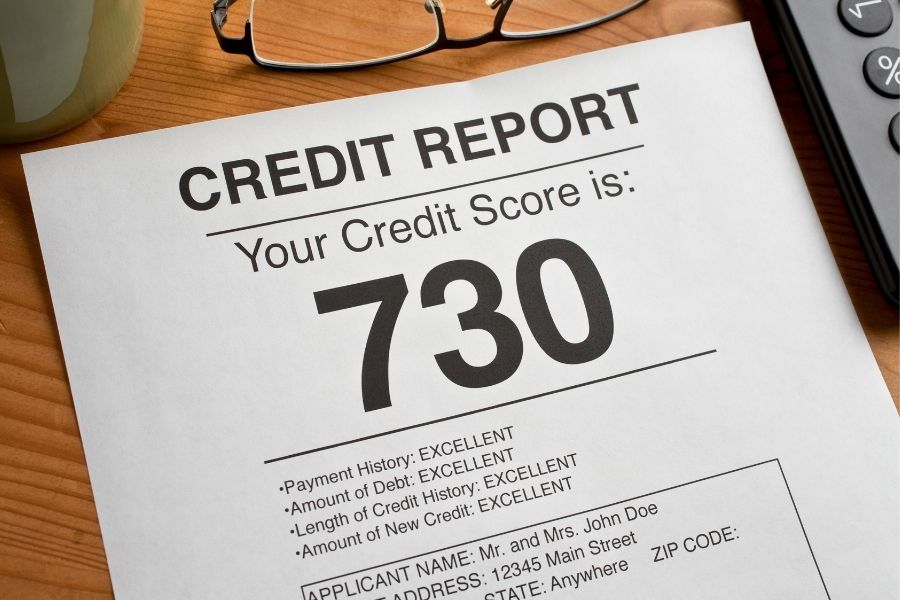

Your Credit Report

A credit report is a list of any credit activity, such as borrowing and repaying, and determines how the credit score is calculated. Credit scores are higher if payments and debts are in check and up to date. Late payments and too much debt for your income score negatively.

Credit history and types of credit (car, student loans, etc.) compute your credit score. Excellent credit is considered at a score of 720 and above, while fair credit sits between 620-659.

Bad Credit

Are you worried about your credit score? It might take some work to clean up your credit a bit by correcting any reporting errors and paying off outstanding debts, but it is possible to buy a house with less than perfect credit.

The government created the VA, FHA, and USDA loans to help as many Americans as possible to buy a home. Their standards are a little more relaxed than traditional home loans, which is why borrowers with lower credit scores often start with a federally backed loan.

Zero Credit

Sometimes, if you don’t have a credit history established, it can be challenging to find loan approval. Talk with your lender for the best options. They might suggest:

- A substantial down payment. More cash equals more access to houses. Lenders love a significant downpayment because it shows you’re heavily committed to the property.

- Finding a co-signer with ideal credit. This partnership is a big decision and won’t be beneficial unless made with clear communication between both parties. Your co-signer must know they’re on the hook to pay your home loan if you cannot make the payments.

- Purchasing a foreclosed home. A federal agency, Fannie Mae, offers a program for first-time buyers that only requires a 3% down payment.

FICO Scores

Lenders also consider your FICO score (Fair, Isaac, and Company) when applying for a mortgage. The FICO score is computed by the information found on your credit report. There are three credit reporting agencies, and each has its own FICO score assigned to you. Maintaining accurate credit reports with Experian, TransUnion, and Equifax helps to ensure correct scores across the board.

FICO scores range from 300-850, and a score near 600 becomes problematic for obtaining credit and loans. Mortgage lenders use FICO scores to determine interest rates and eligibility for different loan products.

back to top

Is a VA Loan the best loan for a military family?

Often it is, but each applicant’s story is different. This is where the need for a knowledgeable mortgage banker is crucial. The VA Loan product is an excellent opportunity for veterans and active duty members for many reasons.

See our Home Financing Overview for Military Homebuyers.

Take a look at the VA loan’s advantages:

- A down payment is not required.

- Private mortgage insurance is not needed because the government partially guarantees VA loans, meaning lenders are comfortable with the risk of lending to someone without insurance.

- Competitive interest rates.

- Veterans and servicemembers with less than perfect credit are still eligible.

- The VA loan mandates reduced closing costs.

- Some veterans with disabilities are eligible to waive the VA loan funding fee.

- No pre-payment or early payoff fees.

- Your VA loan is reusable.

To start the process of applying for a VA loan, talk with your real estate agent and lender. They’ll help you apply for your Certificate of Eligibility (COE) through the Loan Guaranty System. Then, the GLS confirms through the VA your eligibility according to your service record. This is a simple list of the service requirements, but you’ll need to verify your dates with the VA.

- Wartime: 90 days active duty

- Peacetime: 181 in service

- The National Guard and Reserves need six years of service or meet the active duty requirements.

- Spouses of veterans who died during service are also eligible.

For more detailed information about requirements and the application process, read What Is a VA Loan?

What are the fees I pay with a mortgage?

The flat-out repayment of the loan isn’t the only money associated with paying the mortgage each month, although it feels like it because buyers routinely roll fees into their monthly mortgage payment. During closing, buyers are usually responsible for costs, but there are times when sellers work with the buyers and offer credit to help the deal go through.

Common fees include:

- Appraisal

- Tax service provider

- Title insurance

- Other government taxes, property taxes, and homeowners insurance.

What is the difference between an interest rate and an APR?

The interest rate and APR affect the total amount of repayment of the mortgage. Veterans United Home Loans explains the difference as such:

"The Annual Percentage Rate (APR) is the annual cost of a loan expressed as a percentage. When you receive a Truth In Lending (TIL) statement from your mortgage company, the APR will be disclosed. Lenders are required by law to provide you with the APR within certain time frames under the Truth In Lending Act (TILA).

The APR takes into consideration the following items:

- Interest rate

- Origination fees and costs

- Closing agent fees

- Discount points

- Other fees dependent on the specific transaction.

The APR quoted will likely be different from the interest rate because other fees are also considered. By covering the overall cost of the loan, it becomes easier for the borrower to compare different loan products and mortgage companies. When shopping for a home loan, it is best to compare the APR rather than the interest rate to find which company is offering the most competitive overall deal."

What is an escrow account?

Escrow is the money or paperwork needed for closing that is held by a nonaligned third party. The homeowner can also pay into an escrow account held by the lender to cover taxes and insurance.

What is a closing?

The closing is the last part of a real estate deal. The closing date is typically agreed upon during the negotiation portion of the transaction and usually is several weeks after a formal offer is accepted. On the closing date, the buyer finally becomes an owner.

On closing day, buyers present their homeowner’s insurance, copy of the contract, home inspection reports, and all the evidence the bank required to approve the loan. You’ll also need a photo ID with the exact name that appears on the property’s title and mortgage.

If you planned to make a down payment or pay your closing costs separately, closing day is the day to pay up. Wire transfers and cashier’s checks are standard. It’s also a good idea to bring a personal check for small amounts for unforeseen administrative payments.

Military members often prefer remote closings because they’re less expensive than traveling multiple times to the house’s location and the convenience factor is high. But tread carefully; only experienced real estate agents do this well. When initially interviewing agents to hire, ask if remote closings are part of their expertise if you feel there’s a chance you won’t be in the area.

What to Expect When You Close on a Home will help you understand more details of the closing and processes and how to handle unexpected circumstances.

Do I need homeowners insurance?

If you’re borrowing from a lender, then homeowners insurance is required. In reality, owning a home without insurance is extremely dangerous and shouldn’t be considered optional in any case. Homeowners insurance not only protects the owners from physical property damage from a wide range of destructive factors, but from legal and financial disasters as well.

Securing a mortgage and officially buying a home is a long, detailed journey. However, understanding a few key basic concepts before wading into specifics gives potential buyers the power to be informed and investigate the best options for their financial and lifestyle obligations.

By Dawn M. Smith

back to top