Photo from Canva

What you'll find in this article:

An unexpected path to landlord life isn’t really all that unexpected if you're a homeowner serving in the military, is it?

Although you may have done your best to avoid moving earlier than planned, circumstances related to military life more often than not change the way we deal with everything from school enrollment to spouse career searches, but especially when it comes to real estate.

Renting, buying, and selling are complicated transactions on their own; add in an unforeseen set of orders or a long term deployment, and things get tricky fast. There’s also the difficult situations so many face such as divorce or death. These, piled onto homeownership, makes an unexpected landlord life even more likely.

What Should You Do First?

First, you’ll have to make an educated decision, and the answer may surprise you. Starting and maintaining a successful rental business requires planning, follow-through, (even if you choose to hire a property manager), and money available to spend on the property for scheduled and surprise maintenance. Renting a home to tenants isn’t as passive as you might think, especially if you’re living long distance or investing in your military retirement.

If you’re still ready to rent your home, read on!

.jpg)

back to top

Finding Help

No one learns a new skill without teachers! Learn from fellow military landlords and take their advice. It's certain you’ll make a few mistakes, but by tapping into landlord groups online, you’ll recognize the fatal mistakes to avoid. You’ll also find the small bits of advice that make landlord life much easier. Leads for local handymen, property managers, and other professionals are invaluable for a homeowner who wasn’t planning to rent their home.

Facebook and Nextdoor are also good places to start reading up on local trends about housing in your neighborhood. The big topics, such as legal issues and rental income, will be discussed and enhanced by the details of local homeowner’s experience.

You can’t go wrong with the wisdom found in 7 Things to Know Before Renting Out Your Home and 8 Lessons for a First-Time Landlord. These resources will boost your landlord knowledge and help you decide if you’d like to commit to the lifestyle.

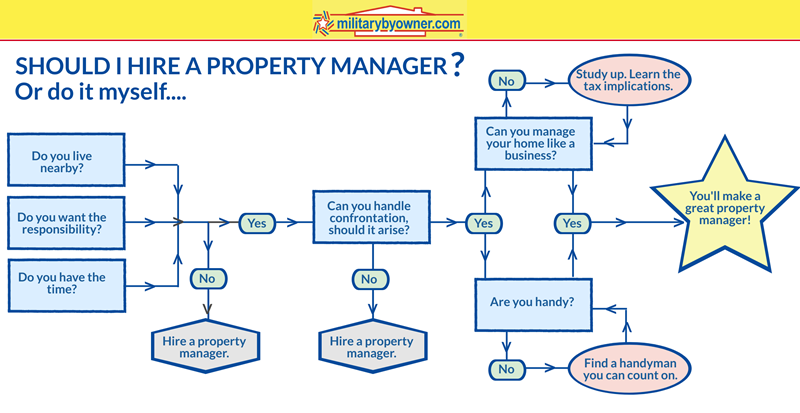

Property Management: DIY or Hire?

At this point, you’ll be weighing the pros and cons of hiring professional property management. Long-distance landlords often consider hiring a property management company because they find peace of mind from hiring a dedicated source to protect their property. The company will provide convenience and security, but at a cost, usually about 10% of the monthly rent.

If you’re considering managing the property on your own and have a short timeline to prepare, hiring a real estate professional on an hourly consultancy basis to guide you on the ups and downs of landlord life could save plenty of time and money, especially when learning to price and market your property.

They’ll help you dig in and see what your local rental market can bear. You’ll learn to assess similar rental properties in the area to get an idea for pricing guidelines, but other factors will come into play, especially if the property is located in a military dense area and BAH allotments are heavily considered. Additionally, the location of quality schools, commuting options, and the proximity to prized amenities such as shopping all make a difference when calculating rent.

Becoming Your Own Property Manager lays out more of the details required to be a successful property manager.

Prepare Your Finances for Your New Rental Business

Although you might not realize it at first, as the homeowner operating a rental, you are a business owner. You are in the business of keeping your mortgage paid while maintaining your property safely and legally.

For most homeowners who decide to rent their property, one of the biggest questions is how much to charge for rent. Yes, the mortgage has to be covered, but there’s so much more that goes into the formula. Taking into account several factors changes the rent per month payment significantly. Smart owners budget for many circumstances.

Take a look at these scenarios when extra money is needed.

- There will most likely be an increase in insurance payments from the conversion of a homeowners policy to a rental property.

- Any unsafe features in the house have to be repaired before tenants arrive. Although your family might know how to navigate the broken stairs or handrails, as the landlord, you’re legally bound to provide basic safety measures to include smoke and carbon monoxide detectors.

- A home warranty provides protection and repairs for the property, but premiums vary from $100s to $1000s, depending on the extent of the coverage. Most average $600 annually.

- If forgoing a home warranty, landlords need access to money for home repairs. Big-ticket items include HVAC systems, kitchen appliances, and possibly displacement accommodations for your renters if the property becomes uninhabitable while repairs are finished.

Before these considerations, you probably thought covering the $2,000 per month mortgage was the number to aim for. But, it's clear, you’ll need to charge more than that to fund the additional homeowner expenses incurred while renting.

Legally and Safely Rent to Your Tenants

Turning your home into a rental property requires legal attention to protect not only yourself and the property, but your tenants and their safety.

Photo from Canva

Because safety comes first, investigate the changes needed to switch your homeowners insurance policy to a rental property policy. The change will adjust not only your premiums but the amount of coverage you and your tenants will receive in the event of a multitude of disasters.

For more information on coverage, Renters and Landlord Insurance: Don't Get Burned! debunks myths about homeowners and rental insurance.

Become Familiar with the Fair Housing Act

For the unexpected landlord, the Federal Fair Housing Act might catch you off guard, but before considering turning your home into a rental property, you must consider the terms of the FHA to stay compliant. These laws dictate rental practices and aim to avoid discriminatory behavior regarding race, color, national origin, religion, sex, familial status, and disability.

As a landlord, you are subject to having a complaint filed against you through the Department of Housing and Urban Development if you’ve refused a tenant for reasons related to the protected classes above.

Find detailed information about everything a landlord should know about the FHA in What Homeowners and Landlords Should Understand About the Fair Housing Act.

Photo from Canva

As a military landlord, there’s a significant chance you’ll want to serve other military families. But, did you know, your marketing cannot specifically state military members are the only group of people you will rent to? This discriminates against otherwise credible potential renters. The same holds true regarding marketing toward families with or without children.

Accommodations for renters with disabilities are also required to be implemented if requested by the renter. These changes may be a small improvement project such as adding portable grab bars in the shower or they could be as encompassing as allowing the renter or their family member to bring their medically required service dog. The FHA and Americans with Disabilities Act bypass a “no pets” rule or a dog breed restriction.

Learn more:

back to top

Lease Options

Normally, the lease offered to a renter has information within that not only outlines the do’s and don’ts of living in the house, but it is a legal document with the power to enforce laws, as well as protect the owner and the tenants from dozens of circumstances. An accurate, up to date, state-specific rental agreement is worth investing in.

Although there is general language in the document, the lease is individualized for each rental transaction. Customization to consider:

- Rental payments: amount, due date, how payment is made, penalties for late payment, what does rent include? (lawn care, HOA fees, etc.)

- Renter’s insurance: require proof before final agreement, how much coverage is required.

- Availability dates: move-in date, length of the agreement, option to renew.

- Pet policy: deposit amount, how many animals, and what kind, cleaning required.

- Subleasing: whether or not prohibited and under what conditions.

- Military clause: spell out to tenants their rights and responsibilities under the SCRA. Everything Renters and Landlords Should Know About the SCRA and the Military Clause provides clear info for each party.

- Other concerns: smoking policies, maintenance schedules, advance notice for walk-throughs, modifications to interior and exterior, who pays for home warranty calls.

Prep the Property for Your Tenants

Preparing your home for your tenants is pretty similar to the process of selling the home. Cleaning, deodorizing, and repairing are first on the list, but adding luxury touches will secure the best tenants and get the most rent per month.

Do you know What You Should Be Doing Now to Sell or Rent Your Home Later?

If your move wasn’t planned, you might not have considered the updates the home needs to draw the best renters or if you would like those improvements to be ready (and paid for by your rental income) if you were to move back after two to three years. Although it might initially seem counterintuitive to redo a bathroom or kitchen right before you move across the country, the renovations could bump the amount of rent earned each month or possibly enhance the amount of a future sale.

The house has to appeal to a renter shopping through an HGTV filter. They have a few ideas in mind, whether possible or not! Give them a couple of the easy to install features, and they’ll be more inclined to pay the fees you’re asking and for longer lengths of time. Neutral paint, updated light fixtures, and a good dose of curb appeal go a long way.

Why pets and carpet don't work in a rental home.

After deciding if your property is pet friendly, consider flooring upgrades that might save money over the life of the rental. The most obvious update is to remove the carpet. In the lease, you can stipulate the carpet be professionally cleaned every so often, but the quality of the existing carpet and the thoroughness of the cleaning leaves a lot of gray area as to what constitutes as clean.

Without carpeting, owners avoid normal wear and tear, tough pet stains, odor, and the potential for mold after a flooding accident. Alternate flooring could easily pay for itself after the first round of tenants.

Replacing the carpet with quality engineered wood, or a high-end wood tile look-alike delivers a substantial return on investment and alleviates many of the hassles inherent to wall-to-wall carpeting. Plus, hardwood floors are always on top of a buyer’s wish list, in case you ever do decide to sell.

When the cleaning and updates have been completed, set everyone up for successful arrival and departure walk-throughs by documenting the condition of the house. Thoroughly photograph and video the home before the tenants move in, taking particular notice of features you’re especially concerned about, such as carpeting.

Photo from Canva

Prepare a preventive maintenance schedule.

Take note, long-distance landlords, in particular, the more effort you put into correcting and preventing maintenance issues before you leave, the less likely you’ll get a frantic call about a gushing water heater or a sincere request for a solid power washing to remove mildew from the siding.

Provide your tenants with the maintenance schedule you’d prefer. Upkeep can be done seasonally, such as leaf removal, or monthly, like HVAC filters. Other options include gutter and window cleaning and landscaping. These items should be included in the lease and clearly laid out as to who pays for each service and how often. Some homeowners prefer to hire services they trust and include maintenance fees in the rent price, such as lawn care.

Leaving your tenants a clean home free of the troubles that come from ignored upkeep ensures their happiness and the likelihood they’ll maintain the condition of the house. It also lets you, as the owner, sleep a little more soundly at night knowing you’ve done your best to avoid disaster. As a proud landlord and business owner, you’ll want to provide the optimal move-in condition for your tenants.

back to top

Marketing Your Rental

If luck is on your side, a few conversations with neighbors will put the word out about the availability of your newly established rental property and you’ll be inundated with perfect would-be renters. But the more likely scenario is that you’ll need to market your home.

What is a solid marketing plan for a novice landlord? There are particulars you won’t be able to avoid, such as superior photos of your rental. This means photos of a clean, clutter-free home taken in the daytime with as much natural light as possible, leaving out humans and pets.

After scoring the best pictures, you’ll want to list your home online--start with MilitaryByOwner’s ad packages, which will help you reach the incoming military community needing a home to buy or rent near your local military base. You can also share your home’s listing on your personal social media. In your description, highlight the property’s best features and include the buzzwords your searchers will be drawn to.

Add in neighborhood or school names if they’re in demand or mention how quick the commute is to the nearest military base. Don’t forget the meat of the ad: rent price, availability, pets or no pets, and the number of bedrooms and bathrooms.

Here’s more help on How to Create an Unforgettable Home Listing.

Tenant Search

Although landlords must comply with the Fair Housing Act, they do not have to accept any renter that shows an interest in the property. Tenant screening helps homeowners find a good fit for their home.

After showcasing your property through multiple marketing avenues, you’ll likely find yourself with potential tenants who want to move on with the rental process. Begin with a rental application. These applications typically permit the landlord to perform a credit and background check. Use the services of a company like SmartMove to do a comprehensive check for you.

These reviews will reveal the most qualified candidates, but it is up to you to put in the one-on-one time through phone calls, emails, and hopefully an in-person meeting. Establishing a human connection strengthens the landlord/tenant relationship.

Communication is crucial during the early stages of tenant screening and approval. Expect to answer many questions and provide honest feedback to your tenants. This avoids the problems that come from miscommunication and expectations that aren’t met.

Photo from Canva

The Future of Your Rental Property

Truthfully assessing your intentions for the property beyond the required time as a rental sets the tone for your new rental business. Ask yourself these questions:

- Could you have another unavoidable move?

- Will you move back quickly?

- Can you see yourself as a landlord indefinitely?

- Will this rental be part of our overall retirement investment?

The answers to these questions might not be obvious right off the bat. But, as the term of your rental agreement moves on, you’ll find your comfort level with all that’s involved with renting your home. Keep detailed financial records, document house issues, and stay tuned in to how you feel overall as a landlord. With this information, it will be easier to make a future decision on whether or not to maintain the property as a rental or to sell when the time is right.

By Dawn M. Smith

back to top