Photo from Canva

In this article:

Military homeowners have dozens of tasks to consider if they’re planning to either sell or rent a home. The list is lengthy and filled with to-do's like market research, cleaning and prepping for advertising photos, and interviewing real estate agents.

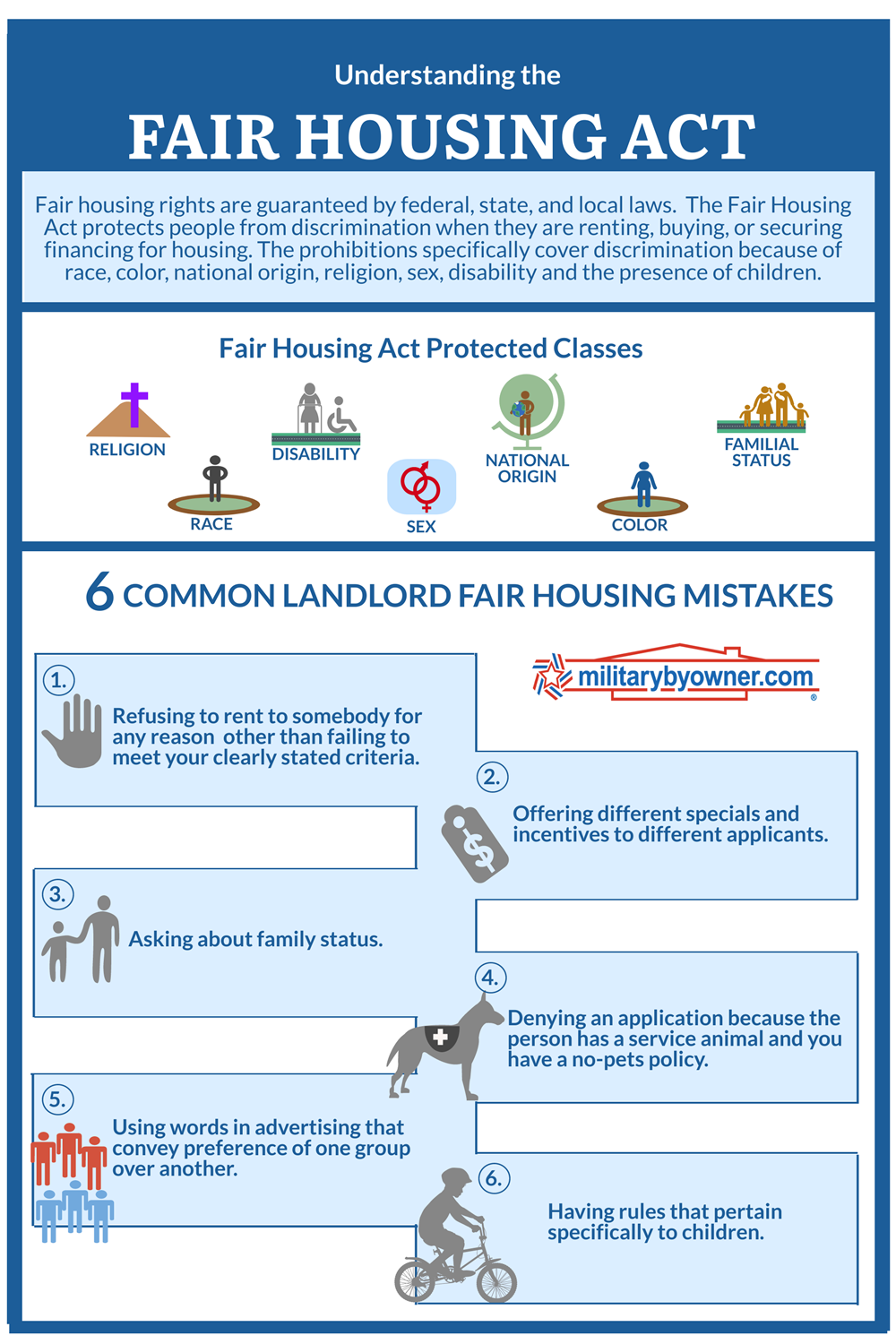

One thing to add to your list, especially if you're selling or renting for the first time, is "Understand the Fair Housing Act.” The Fair Housing Act is federally mandated to protect buyers and renters from discriminatory practices during real estate transactions, including securing financing.

What to Know Before Listing Your Property for Sale or Rent

As the homeowner or landlord, you likely have no intention of discriminating against anyone interested in your property, but even with your best intentions, inadvertent discriminatory language could get a complaint filed against you with the Department of Housing and Urban Development (HUD).

Photo from Canva

For example, although you truly feel your neighborhood is not suited for small children (no sidewalks, playgrounds, or schools nearby) if you add the words “child-free families only” in your advertising, you are most definitely discriminating against families with kids.

Or if you’ve ever advertised your rental property as “seeking military members to rent,” thinking you’d like to support the troops, this actually violates the Fair Housing Act. As the landlord, you cannot convey a preference for one group over another. For more information about restricted uses words, phrases, symbols, and visual aids in advertising see HUD’s guidance for Fair Housing Advertising.

If all of this sounds a little confusing, let's start from the beginning to see why and how the Fair Housing Act was created.

The History of the Fair Housing Act

As part of the 1968 Civil Rights Act, the Fair Housing Act (FHA) was written to fight against the rampant racial segregation within collections of housing. In simple terms, the FHA forbids housing discrimination based on race, color, religion, national origin, sex, disability, and familial status. The initial 1968 legislation did not include protections for the qualifiers of sex, disability, or familial status. They were later added in 1974 and 1988, respectively.

Local governments may also insert protected classes of people into the federally protected group already established. It's common to see states or cities legislate discrimination against people with certain income levels, military history, marital status, sexual orientation, or gender identity.

Recent Fair Housing Act Updates and Clarification

Because of a few gaps in previous fair housing legislation, HUD created additional guidance to address discrimination tactics used against buyers and renters. These are related to criminal history, maximum occupancy in rental homes, and limited English proficiency.

Criminal History

In 2016, HUD added this language to clarify discrimination against those with a criminal history:

“Thus, where a policy or practice that restricts access to housing on the basis of criminal history has a disparate impact on individuals of a particular race, national origin, or other protected class, such policy or practice is unlawful under the Fair Housing Act if it is not necessary to serve a substantial, legitimate, nondiscriminatory interest of the housing provider, or if such interest could be served by another practice that has a less discriminatory effect.”

English Proficiency

The lack of English language proficiency or employing English as a second language is considered a subset of national origin, which cannot be used to disqualify renters, as their national origin is protected by the FHA.

Maximum Occupancy

The FHA does not explicitly prohibit occupancy limits but creating advertising that sets a maximum occupancy could lead to discriminatory accusations from potential renters. This is especially true if you’re considering limiting the number of children allowed to live in your rental home.

Determining the lawful number of occupants is challenging, as it must take into account the FHA, state and local regulations, and the physical qualities of the rental home including square footage, size of the bedrooms, and unit layout.

The Keating Memorandum is an HUD created guideline for homeowners and landlords to help determine the maximum occupancy which generally states only two persons are allowed for each bedroom. Infants under the age of 1 are not counted toward total occupancy.

back to top

What Homeowners Need to Know Before Renting or Selling

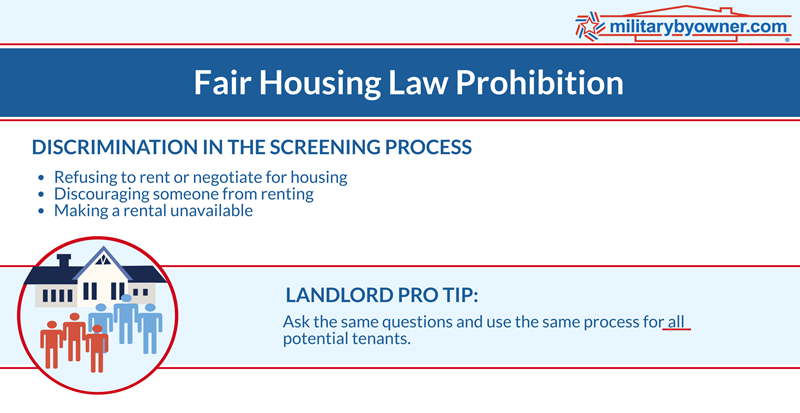

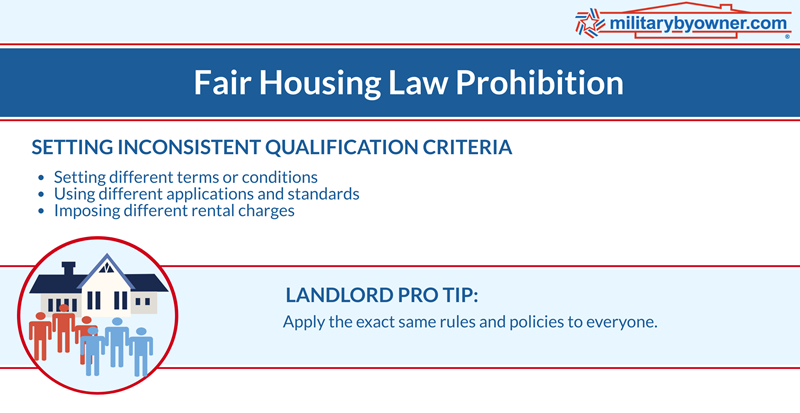

In addition to avoiding any discriminatory behavior against the protected classes, homeowners are legally bound to uphold the same terms and conditions for each applicant. Homeowners cannot attach different qualifiers to a protected class applicant, for example, requiring a security deposit for one set of renters, but not another.

Discriminatory verbal or written statements are also illegal, as is misleading an applicant as to the availability of the property. If a family with young children requests to apply, you may not tell them it has been rented only to later rent to a single tenant.

In a survey of 2,300 National Association of REALTOR members, 11% say a transaction of theirs failed to close due to a fair housing issue, including the agent's refusal to work with someone they perceived to be discriminatory.

Photo from Canva

It's common for landlords and homeowners to be unaware or confused by what the FHA requires regarding disabilities. As the owner, you must make reasonable accommodations to their living conditions to enjoy all parts of a rental house that a non-disabled person would. This includes allowing and paying for reasonable accommodations, such as service and support animals. The animals have to be acknowledged even if the property is advertised as “no pets allowed.” Read more about this below in The Fair Housing Act and Military Life.

If a complaint is filed against you, HUD has a process to investigate the incident. HUD maintains the authority to take depositions, issue subpoenas, interrogatories, and compel testimony or documents. Simultaneous to the investigation, both parties and HUD can go through a voluntary process called conciliation to remedy the situation, but the result must be in the favor of the public’s interest in order for the investigation to close.

If not compliant with the FHA, owners face expensive litigation and likely fines for the violations. For 2021, HUD describes the following FHA discrimination penalties:

“Under these revised amounts, someone can be assessed a maximum civil penalty of $21,663 for his or her first violation of the Fair Housing Act. Respondents who had violated the Fair Housing Act in the previous 5 years could be fined a maximum of $54,157, and respondents who had violated the Act two or more times in the previous 7 years could be fined a maximum of $108,315.”

It’s also important for homeowners to know of exceptions to the FHA. It exempts owner-occupied buildings with four or fewer units, single-family housing sold or rented without the use of a broker, and housing operated by organizations and private clubs that limit occupancy to members.

Keep in mind, however, that advertising with discriminatory language may not be used, even if the exception is legal. This is why you’ll notice that age-related communities such as “Active 55+ Adults” are permitted. Still, even in this circumstance, 80 percent of the units occupied have to be by people ages 55 or older.

Owners do reserve rights to legally reject applications, evict renters, and defend their property if they have valid reasons that do not relate to the protected class descriptions. Nolo’s Legal Encyclopedia offers this example to clarify a homeowner’s rights:

“A landlord who rejects an applicant because she's female and Hindu is violating the FHA's ban on discrimination based on sex and religion. But a landlord who rejects a female Hindu applicant because she has poor credit or can't afford the rent isn't violating the FHA—assuming the landlord applies the same screening requirements to all applicants.”

Landlords Who Use Consumer Reports for Rental Property

If you choose to run background checks on potential tenants, be aware that the Fair Credit Reporting Act (FCRA) requires steps to be taken to deem the investigation lawful. Review consumer reports with the FHA in mind in addition to local protections. Although you might feel you have the right to refuse applicants for specific reasons noted in consumer reports, such as criminal history, this may be in opposition to the applicant’s rights protected by the FHA.

Traditionally, credit checks come from sources like TransUnion, Experian, and Equifax. In addition, tenant screening services provide rental history, background checks, and reports from previous landlords and housing court records.

Get tenant screening help from SmartMove, part of TransUnion.

After reviewing the reports, landlords can choose to perform adverse actions against the applicant. Adverse actions impede the application processes and include:

- Denying the application.

- Requiring a co-signer on the lease.

- Requiring a deposit or larger deposit that would not be necessary for another applicant.

- Raising the rent to a higher amount than for another applicant.

If the landlord performs any of these adverse actions, they are obligated to let the applicant or tenant know either orally, in writing, or electronically. Landlords must obtain permission to seek these reports, usually included in the application that is required to apply for tenancy. It also has to be stated with the reporting agencies that you are only using the report for housing purposes.

The Fair Credit Reporting Act mandates the destruction of the reports after the pertinent information is used. This includes burning, pulverizing, or shredding paper documents and deletion of electronic information. The Federal Trade Commission governs the FCRA and provides landlords with more information about consumer reports and adverse actions on their website.

The National Fair Housing Alliance

The National Fair Housing Alliance (NFHA) works hand in hand with HUD and is regarded as a leading civil rights organization that specializes in monitoring and reporting on all topics related to fair housing.

“NFHA began collecting data about fair housing complaints that consumers file with private fair housing groups, the Department of Housing and Urban Development (HUD), the Department of Justice (DOJ), and state and local government agencies 25 years ago. Although seven fewer agencies reported housing discrimination data to NFHA in 2021 than the previous year, there were 2,504 more housing discrimination complaints filed by consumers. The unprecedented number of 31,216 complaints represents an 8.7 percent increase as compared to 2020 when 28,712 fair housing complaints were filed.”

Although the number of housing discrimination cases may seem like a small number compared to the population in the U.S. who buy or rent homes, The NFHA estimates that over 4 million instances of housing discrimination occur annually; the vast majority of occurrences do not get reported. Most of these instances are unknown to the housing seekers because they don’t realize there are laws to protect them while searching for housing.

Although 25,000 housing discrimination cases may seem like a small number compared to the population in the U.S. who buy or rent homes, The NFHA estimates that over 4 million instances of housing discrimination occur annually; the vast majority of occurrences do not get reported. Most of these instances are unknown to the housing seekers because they don’t realize there are laws to protect them while searching for housing.

back to top

The Fair Housing Act and Military Life

While living in off base housing, military members are protected under the FHA which means there are a couple of scenarios to familiarize yourself with to avoid potential discrimination issues. The allowance for children and service animals to live in a rental house is a common need military family tenants require.

Photo by af.mil/MSgt Philip Speck. Public domain image.

Renting to Military Families with Children

Far more military families have children than do not, so the odds are you’ll come across a renter who needs housing for children. Prepare yourself, the property, and your marketing to welcome children of all ages. The FHA does not allow the homeowner to advertise their property as “child-free” or “only older children allowed,” for example. This is discrimination against the potential tenant’s familial status.

The FHA also says that you may not redirect families to other rental openings you may own or in the area solely based on the fact they have children. You also cannot dismiss their application because they have kids, and you cannot charge more in fees or rent per person due to the number of children who will live in the home.

Be careful of this discrimination tactic that you might unknowingly use— “kid-friendly” is often a term used to show parents the conveniences of schools and playgrounds, but this is deemed as a discriminatory practice by the FHA because you are essentially steering them from other properties that are also suitable for their needs.

Marketing Your Home for Rent to Military Families will help you find the best tenants for your property.

Tenants with Disabilities

Landlords cannot refuse to rent their property to a person with a disability, either mental or physical. More than 20 years of active war has the number of servicemembers with disabilities climbing. And, chances are, as the homeowner, you’ll be bound by the FHA to provide reasonable accommodations if the tenant requests the adjustments.

Photo from iStock.com/RonBailey

Section 504 of the FHA states, “reasonable accommodations must be provided and paid for by the housing provider unless providing them would be an undue financial and administrative burden or a fundamental alteration of the program.”

Here’s what the Department of Justice and HUD have to say about reasonable accommodations.

“A ‘reasonable accommodation’ is a change, exception, or adjustment to a rule, policy, practice, or service that may be necessary for a person with a disability to have an equal opportunity to use and enjoy a dwelling, including public and common use spaces.”

This document also explains how the homeowner should handle the process of implementing the accommodations, known as the interactive process, the instances when homeowners do not have to make the change, what type of information the homeowner is legally allowed to ask about the disability.

Accommodations range from large, such as providing access for a wheelchair ramp and allowing for service animals, to smaller in scope accommodations, such as installing fire and smoke alarms for hearing impaired tenants or grab bars in showers for those with mobility problems.

Renters with Service Animals

An accommodation that is common among military families is the need for a certified service animal. Certified, trained, and registered service animals are typically dogs and are protected not just by the FHA, but also through the Americans with Disabilities Act. For a refresher about the ADA and service animals, read Frequently Asked Questions about Service Animals and the ADA.

An emotional support animal (ESA) is somewhat different but also protected by the FHA. If a tenant asks for this accommodation, you may inquire about the animal’s (an ESA is not always a dog) official documentation from a doctor or therapist and the reason for the animal if it isn’t apparent.

Photo from Canva

The American Bar Association provides this guidance when considering a tenant’s request for an ESA:

“When assessing a tenant’s request for an ESA as a reasonable accommodation, the landlord is permitted to consider the financial and programmatic repercussions of allowing an ESA onto the premises. Considerations can also include the potential disturbance the animal may pose to other tenants. Generally, this is a difficult burden for a landlord to meet. But if the ESA is shown to be particularly disruptive or the tenant fails to take proper measures to ensure that the ESA does not bother other tenants, the landlord may be justified in denying the reasonable accommodation or even evicting the tenant.”

HUD does not consider an ESA a pet and forbids property owners to ask tenants for a pet fee or deposit.

How a Real Estate Agent Can Help

It’s up to the landlord, renter, homeowner, and buyer to familiarize themselves with the FHA to maintain fairness during any real estate transactions, but the guidance from a real estate agent can prove to be invaluable for avoiding any missteps.

Photo from Canva

A real estate professional is prohibited from discriminating against any protected class and in fact, is held to higher standards in fair housing matters. This is why when a client asks, “Is this area safe?” or “Are the schools good?”, an agent has to explain that they cannot answer these questions as they are likely violating the FHA.

Even if the agent’s client requests transactions that are framed in an off-the-cuff manner and not viewed discriminatory by the homeowner, but the agent knows the requests violate the FHA, the agent cannot legally fulfill the transaction. The agent may even feel it necessary to report the unlawful request to a local housing agency or HUD.

According to the same REALTOR Magazine survey, 64% of agents discuss fair housing with buyers and sellers, with only 26% of clients bringing up fair housing issues. Real estate groups gladly take it upon themselves to continue and maintain their education about the FHA. It's normal for agents to update their local licenses every 2-3 years through FHA training at the local level. Remember, these laws may extend beyond federal stipulations.

Fair housing acts, both federal and local, are designed to help renters and buyers find quality homes regardless of race, color, religion, national origin, sex, disability, and familial status. Violations, although unintentional or made in ignorance of the laws, are still illegal and could have costly ramifications.

Before advertising your property, understand your rights as an owner and ensure the lawfulness of your future transactions. It's also recommended that you consult with real estate attorneys specializing in fair housing acts.

By Dawn M. Smith

back to top